Day trading requires a dedicated mindset and the capacity to interpret market movements. To thrive in this volatile environment, traders must sharpen a comprehensive set of strategies. A key element consists in understanding market behavior. Traders should aim to anticipate movements in sentiment and adjust their strategies in response. Moreover, a reliable risk management plan is essential to reduce day trading potential losses. This involves adopting stop-loss orders and diligently portioning your capital across different trades.

Perpetually education and self-improvement are crucial to staying ahead in the ever-evolving world of day trading.

Conquering the Daily Market: A Day Trader's Guide

The daily market can be a wild beast, but with the right knowledge and mindset, you can emerge victorious. Becoming a successful day trader requires discipline, patience, and a deep understanding of technical analysis. Start by diving yourself in the world of charts, indicators, and trading strategies.

- Develop a robust trading plan that outlines your risk tolerance, entry and exit points, and profit targets.

- Practice your skills with a demo account before risking real capital.

- Remain informed about market news and events that could impact your trades.

Bear in mind that day trading is inherently risky, so never invest more than you can afford to lose. With careful planning, diligent execution, and a commitment to continuous learning, you can master the daily market and potentially achieve your financial goals.

Unlocking Profit Potential: The Art of Day Trading

Day trading offers a unique opportunity to harness market fluctuations for quick profits. Skilled day traders interpret real-time price movements, utilizing technical indicators and fundamental analysis to execute rapid trades. Discipline is key, as day trading demands unwavering focus, agile decision-making, and the ability to mitigate risk effectively.

By acquiring the intricacies of this dynamic market, traders can potentially unlock substantial financial rewards.

Dive into Day Trading: A Beginner's Guide

Entering the world of day trading can seem daunting, but with a structured approach, even beginners can navigate its intricacies. This step-by-step guide will equip you with the foundational knowledge and tools needed to start your day trading adventure. First, immerse yourself the basics of financial markets, understanding key concepts like supply and demand, market orders, and limit orders. Next, select a reputable brokerage platform that suits your needs and budget.

- Practice your skills with a demo account before risking real capital.

- Formulate a solid trading plan outlining your entry and exit strategies, risk management techniques, and profit targets.

- Remain informed about market news and events that can influence price movements.

Remember, consistency, discipline, and continuous learning are essential for success in day trading.

The Psychology of Day Trading: Mastering Your Mind

Day trading can be a highly lucrative endeavor, but it's often more than just technical expertise. To truly succeed in this fast-paced world, you must hone a strong understanding of the emotional factors at play. One key aspect is learning to manage your emotions. The built-in volatility of markets can rapidly lead to feelings of anxiety, which can cloud your thinking.

Another crucial element is maintaining a disciplined approach. Day traders often deal with tempting opportunities and potential drawdowns. It's essential to stick to your trading plan and avoid making emotional decisions based on fear or greed.

Developing a growth mindset is also paramount. The markets are constantly shifting, so it's crucial to regularly learn and adapt your strategies accordingly. Embrace setbacks as opportunities for growth and refine your skills over time.

Advanced Day Trading Techniques

High frequency trading (HFT) has revolutionized the markets by employing complex day trading algorithms. These platforms leverage robust computing infrastructure to execute thousands of transactions per second, exploiting tiny price fluctuations. HFT firms utilize algorithms that can analyze vast amounts of market data in real time, enabling them to identify arbitrage opportunities and execute trades at speedy speeds.

- Essential HFT factors include:

- Market microstructure analysis

- Programmatic order execution

- Colocation optimization

- Volatility management

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Mr. T Then & Now!

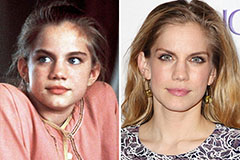

Mr. T Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!